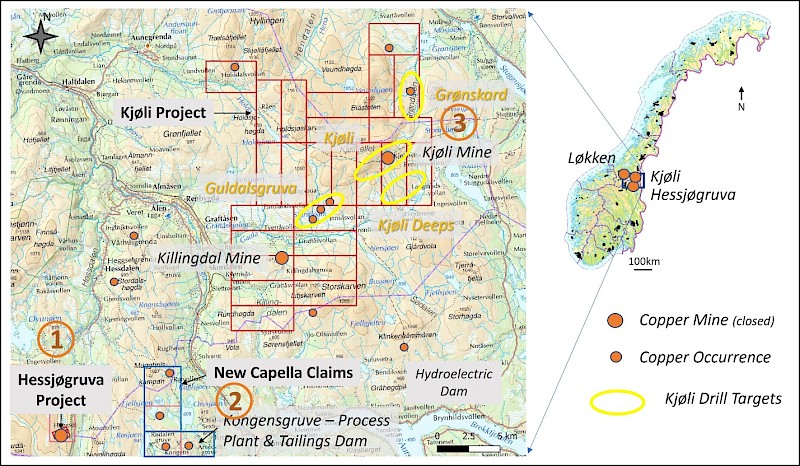

Capella’s Hessjøgruva-Kongensgruve-Kjøli copper-cobalt project (Figure 1) is located in the northern part of the former Røros copper mining district of Trøndelag County, central Norway. The cornerstone asset, Hessjøgruva, was acquired from local company Hessjøgruva AS on April 6, 2022, and is an advanced-stage exploration project with approximately 12,000m of core drilling dating from the 1970’s. Capella’s primary goals for Hessjøgruva for 2023 are to report a Canadian National Instrument 43-101 (“NI 43-101”) compliant Mineral Resource Estimate and to commencing initial development studies.

The adjacent Kongensgruve claim block was staked by Capella in July, 2022, and contains four known former mines (Rødalen, Kongensgruve, Fjellsjøen, and Muggruva) in addition to a former mineral processing facility and tailings dam at Kongensgruve.

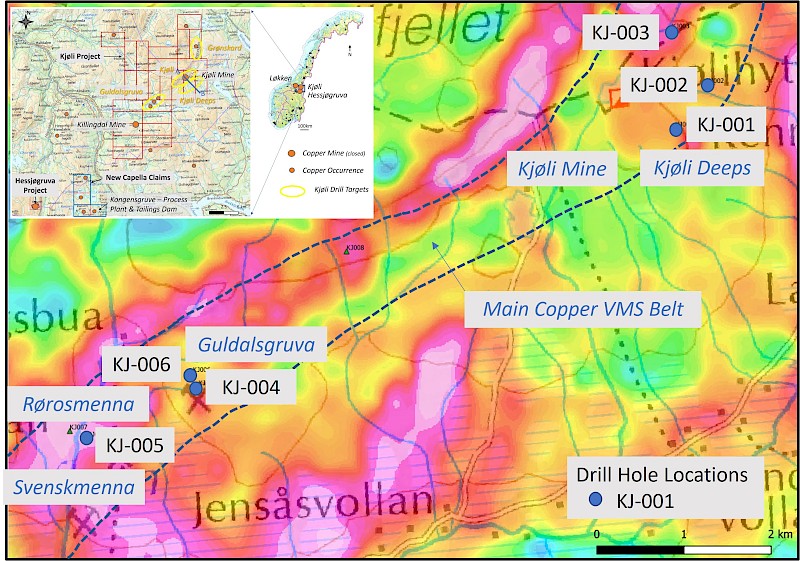

A scout core drill program was initiated in late-January at the adjacent Kjøli project. By February 22, 2023, a total of six holes for 1,080m had been completed on targets along the Kjøli Mine trend (Kjøli Mine and Guldalsgruva sectors) and at Kjøli Deeps (a coincident electromagnetic and gravity anomaly underlying the former Kjøli copper mine). The Kjøli scout drill program is expected to be completed during March, with assay results expected to become available in late April.

The Hessjøgruva-Kongensgruve-Kjøli district is favourably located with regards to infrastructure. Both the main Trondheim-Røros highway and railway line pass through the centre of the project area. Low-cost hydroelectric power is also readily available in the district.

Figure 1. Locations of the principal target areas in the Hessjøgruva-Kjøli district. 1. Hessjøgruva project, 2. Kongensgruve project, and 3. Kjøli project.

Project Snapshot

|

|

|

|

Location |

20km SE of Ålen, Trøndelag Province, central Norway |

|

Ownership |

100% Capella Minerals Ltd |

|

Status |

Exploration-stage |

|

Deposit type |

High-grade copper-rich VMS deposit |

|

Host Rocks |

Meta-volcanic and sedimentary sequences |

|

Age |

Cambro-Silurian, Ordovician orogeny |

|

Main Economic Elements |

Copper, Zinc, Cobalt (minor Silver, Gold) |

|

Access |

All weather paved highways and gravel roads |

Hessjøgruva Project - Highlights

- Systematic exploration (including approximately 12,000m of core drilling) was completed at the Hessjøgruva project during the 1970’s by previous operators, including former local mining company Røros Kobberverk AS. Historical assaying was focused principally on copper and zinc, but not cobalt.

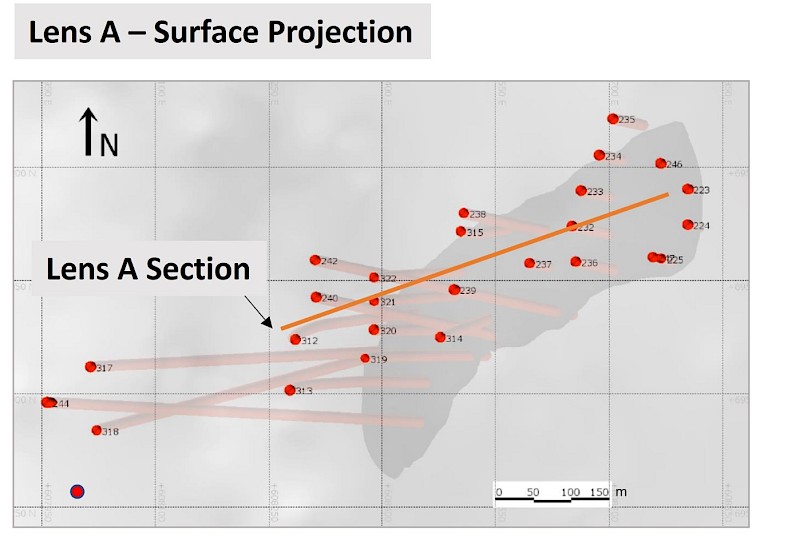

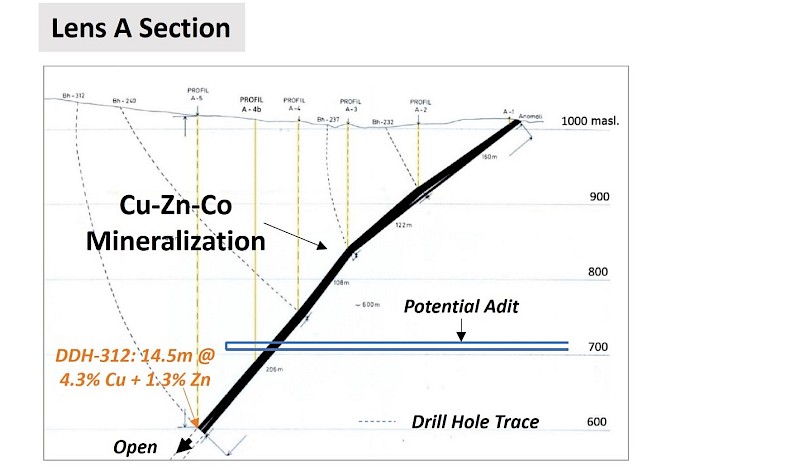

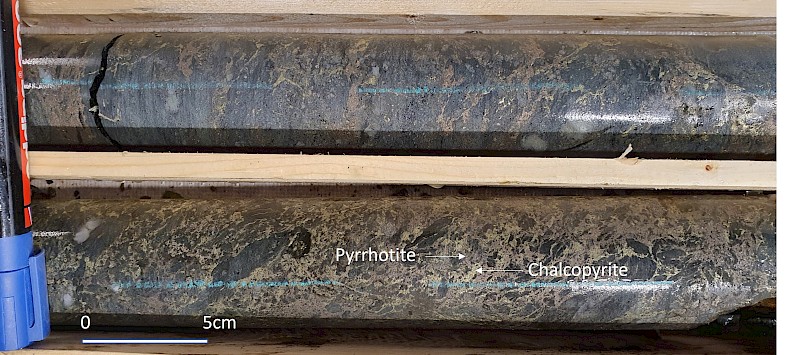

- The copper-zinc-cobalt mineralization at Hessjøgruva is lenticular massive-sulfide (“VMS”)-type (Figure 2), identical to the mineralization type being targeted at both Kongensgruve and Kjøli. The Hessjøgruva mineralization occurs primarily in three lenses (A-C, with Lens A hosting most of the high-grade mineralization; Figures 3&4), all of which extend from surface to >400m vertically below surface and all remain open down-dip. Mineralization is dominated by chalcopyrite, pyrite/pyrrhotite, and sphalerite, with Cu content observed to increase with depth in the deposit.

Figure 2. Massive pyrrhotite-chalcopyrite mineralization at Hessjøgruva. Drill hole DDH-240, interval assays 1.7% Cu + 2% Zn + 0.1% Co. - The average thickness of the highest-grade Lens A is approximately 10m1, with the thickest and highest-grade intercept reported from the historical drilling being 14.5m @ 4.35% Cu + 1.3% Zn (or 4.8% Cu equivalent2) (approximate true thickness) from 455.5m to 470m downhole in DDH-312. This Cu-Zn-Co mineralization remains open down dip.

- Capella announced the filing of an independent Canadian NI 43-101 compliant technical report for the Hessjøgruva project, in which all exploration activities to date have been summarized, on SEDAR (www.sedar.com) on September 8, 2022.

- Capella is currently permitting a summer 2023 drill program at Hessjøgruva which is designed to both infill existing drill grids and extend known mineralization. This is expected to lead on to a National Instrument 43-101 Mineral Resource Estimate for the project and allow for the commencement of initial development studies.

1 Geological Survey of Norway Report 2007.023; The Hersjø ore deposit, evaluation of ore potential.

2 Copper equivalent grades have been calculated using copper and zinc prices of USD 9,900/T and USD 3,700/T, respectively, with no adjustment having been made for metallurgical recovery as these are unknown at this time (metal price data: London Metal Exchange, www.lme.com).

Figure 3. Plan view of diamond drill-holes in high-grade copper-zinc-cobalt mineralization in Lens A, with the surface projection of mineralization shown in Figure 4 also indicated (source: Geometric and Qualimetric Modeling of the Hessjø deposit; Nørsett, S.J. 2016; NTNU M.Sc. Thesis).

Figure 4. Section showing high-grade Cu-Zn-Co mineralization in Lens A (source: Geometric and Qualimetric Modeling of the Hessjø deposit; Nørsett, S.J. 2016; NTNU M.Sc. Thesis). Location of a potential future adit to access high-grade mineralized zones is also shown.

Terms of the Hessjøgruva Acquisition

Capella may acquire a 100% interest in the Hessjøgruva Cu-Zn-Co project in return for:

- Capella managing and funding exploration / development activities on the project.

- Capella paying Hessjøgruva AS a one-time amount of Euro 500,000 upon completion of a positive Bankable Feasibility Study.

- Capella providing Hessjøgruva AS with a 2.5% Net Smelter Royalty (“NSR”) on all future metal production from the project, retaining an option to buy-back 0.5% of this NSR at any time prior to the commencement of commercial production for Euro 1,000,000.

- Capella to cover the cost of annual property payments and basic administration costs.

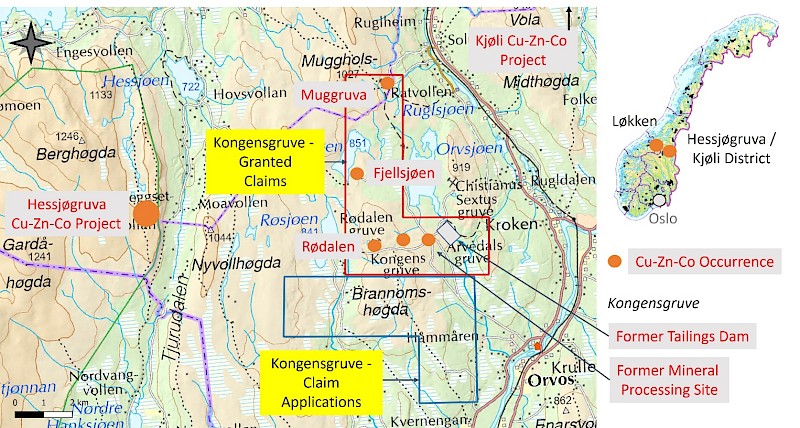

Kongensgruve Project - Highlights

Capella successfully staked 20 square kilometres of exploration claims over the past-producing Kongensgruve area in July, 2022. The central portion of the Kongensgruve claim block lies approximately 6km east of the Hessjøgruva project, contains a series of known copper-zinc-cobalt occurrences (including Rødalen, Kongensgruve, Fjellsjøen, and Muggruva)(Figures 5 & 6), and also covers the site of a former mineral processing plant and tailings dam. An application for a further 25 sq. km of exploration claims was made over open ground located to the south-southwest of the main Kongensgruve claim block (Figure 5).

Figure 5. Capella explorations concessions in the Kongensgruve area.

Figure 6. Former Rødalen mine workings, Kongensgruve project.

Kjøli Project - Highlights

Capella announced the initiation of a 1,250m scout drill program at the Kjøli project in late-January, 2023. By February 22, a total of six holes for 1,080m had been completed on targets along the Kjøli Mine trend (Kjøli Mine and Guldalsgruva sectors) and at Kjøli Deeps (a coincident electromagnetic and gravity anomaly underlying the former Kjøli copper mine)(Figures 7 & 8). The Kjøli drill program is expected to be completed during March, with assay results expected to become available in late April.

Figure 7. Location of the Kjøli Deeps and Kjøli Mine drill holes, overlain on airborne EM data.

Figure 8. Drill hole KJ-004 8-10m. Remobilized, semi-massive chalcopyrite and pyrrhotite in the Guldalsgruva sector.