On January 15, 2026, the Company announced that it had signed a binding Letter of Intent (“LOI”) with Verde Minerals Ltd (“Verde”) with respect to an Earn-In Agreement (the “Agreement”) on the Solana Iron Oxide Copper-Gold (“IOCG”) project in southern Spain. The Solana IOCG project is located 80 km NW of the regional centre / port of Almeria and 20km E of the Alquife iron mine, and is a district-scale (35+km in length) project which includes the former producing Cerro de Gallo and Solana high-grade vein-hosted copper-gold deposits and the copper-rich Conde Xiquena haematite mine.

The Solana project consists of a series of laterally-extensive, NNW-trending haematite-rich copper-gold veins hosted dominantly within Proterozoic-age meta-sedimentary rocks and underlain by felsic intrusions. Whilst future exploration programs at Solana will evaluate the resource potential of the extensive high-grade vein systems, the Company’s primary focus during 2026 will be on the evaluation of buried IOCG-type deposits which the Company interprets to be source for the outcropping copper-gold veins.

Highlights

- The district-scale Solana project consists of a 35+km long belt of high-grade, NNW-trending and haematite-rich copper-gold veins, including the former Cerro de Gallo, Solana, and Conde Xiquena mining operations which ceased operations in the 1920’s. The individual copper-gold veins are laterally-extensive (kilometre-scale), and a cumulative strike extent exceeding 50km have been mapped to date (Figures 1 - 3). Host rocks are dominantly Proterozoic-age meta-sedimentary rocks with underlying felsic intrusions.

- The Solana project lies within the Betic fold and thrust belt of south-eastern Spain, which is linked tectonically to the collision between the Eurasian plate and the African plate (and with the formation of the Rif and Atlas Mountain chains in northern Morocco).

- Previous exploration work completed at Solana (2010-2013) included a 1,775 line km heliborne magnetic / radiometric survey (covering the central portion of the current project area), stream sediment sampling and a mapping exercise including the assaying of 1,300 rock chip samples, and a limited drill campaign in which only three short diamond drill holes were successfully completed. Geophysical surveys (including an initial magneto-telluric - or AMT - survey and a gravity survey planned for 2026) are expected to provide additional information on the buried source of the high-grade haematite-gold-copper mineralization mapped at surface.

- Strong community support exists for new mining projects and a favourable location with respect to both infrastructure (railways, highways, and ports) along with proximity to major renewable energy sources (including the nearby Andasol solar and Cuerva wind energy farms) are key attributes of the project. The Minas de Alquife mine, which was historically Europe’s second largest open-pit iron ore operation, is located approximately 20km due W of Solana along the same regional structural corridor and is currently being assessed by its third-party owners for re-opening.

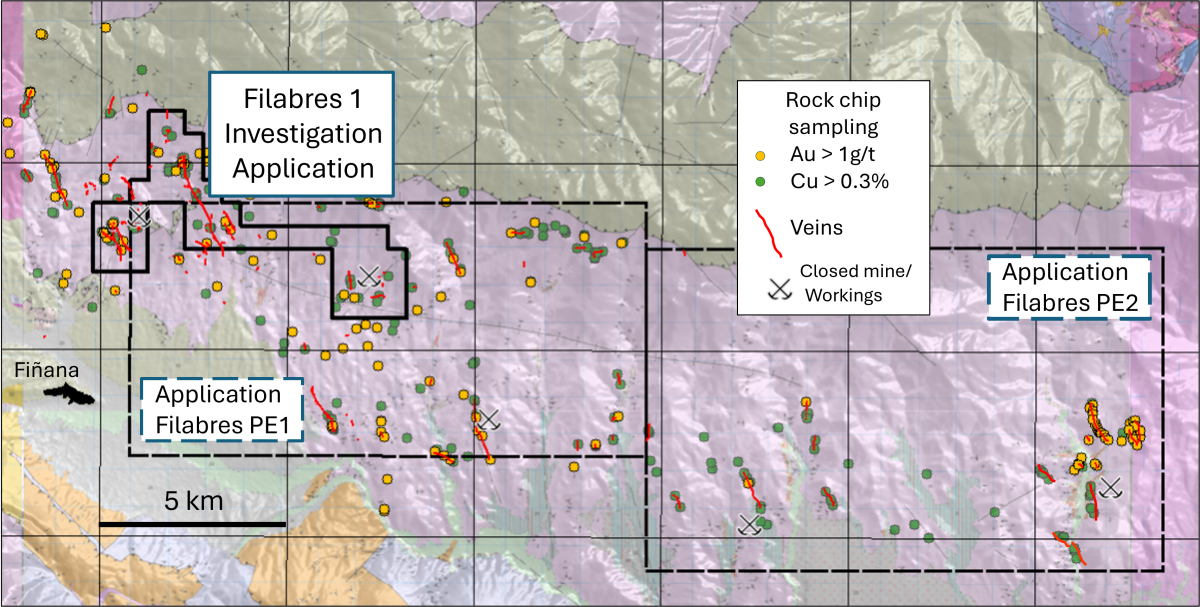

- The Project currently consists of one Investigation Permit (priority application Filabres 1; covering 14.6 km2) and two Exploration Permit applications (Filabres PE 1 & 2; covering 212 km2 in total).

The Company expects exploration activities to commence immediately at Solana, with initial drill target definition in early-2026 to be followed up by first-pass diamond drilling in late-2026. Seasoned geologist John Gray has been designated Project Manager for Solana.

Figure 1. Regional geological setting of the Solana project (Spanish Geological Survey – IGME; LHS), together with an overview of the former Cerro de Gallo mining operations (and an interior view of the main mine access at Cerro de Gallo)(RHS).

Figure 2. Haematite-rich copper-gold veining from the Cerro de Gallo area.

Figure 3. Filabres 1 Investigation Permit and Filabres PE 1 & 2 Exploration Permit applications with mapped haematite-rich copper-gold veins and copper and gold assays at the Solana Project.

Terms of the LOI

- Capella will have the option to acquire an initial 75% interest in the Solana project from Verde’s 100%-owned Spanish subsidiary Cobre y Oro Andaluz (“CyOA”) through the following staged earn-in agreement:

- Phase I - Capella will have earned-in to an initial 30% interest in the project by completing the minimum exploration commitment (as stipulated by the Andalucia mining authorities) on each granted permit within 12 months. Capella’s minimum spend on the Filabres 1 permit for 2026 will be Euro 290,000.

- Phase II – Capella will have earned-in to a 51% interest in the project by completing the minimum exploration expenditure on each granted permit within 24 months of their respective grant dates.

- Phase III - Capella will have earned-in to a 75% interest in the project by completing the minimum exploration expenditure on each granted permit, and completing a Pre feasibility Study, within 72 months of their respective grant dates.

- After Capella has completed the earn-in to 75%, Verde will have the option to either maintain its 25% interest in the project by funding its pro-rata share of project expenditures, or dilute out to a 2% NSR using a standard industry dilution formula.

- Capella to provide Verde with a refundable Euro 70,000 environmental bond to be lodged with the Andalucia government for the granted Filabres 1 permit

- Capella to pay Verde the amount of Euro 115,000 upon signing this LOI. In addition, Capella will make annual payments of Euro 50,000 to Verde upon the first of either i) the relinquishment of all properties that form of this agreement or ii) Capella completes all items required as per Phase III of the Agreement.

- Seasoned geologist John Gray has been designated Project Manager for Solana.

The binding LOI with Verde remains subject to acceptance by the TSX Venture Exchange.