Capella holds an initial 70% interest in the Northern Finland Copper-Gold Project, which is located in the highly prospective Central Lapland Greenstone Belt (“CLGB”). The 70% project interest was acquired from ASX-listed Cullen Resources Limited (ASX: CUL)(“Cullen”) through an earn-in agreement announced on August 24, 2021. The original agreement with Cullen covered the Katajavaara exploration permit licence application (“EPLA”) and Aakenus reservation, both of which lie immediately adjacent to the Sirkka Thrust Zone, a regional structural corridor within the CLGB which is associated with numerous occurrences of both gold and base metals.

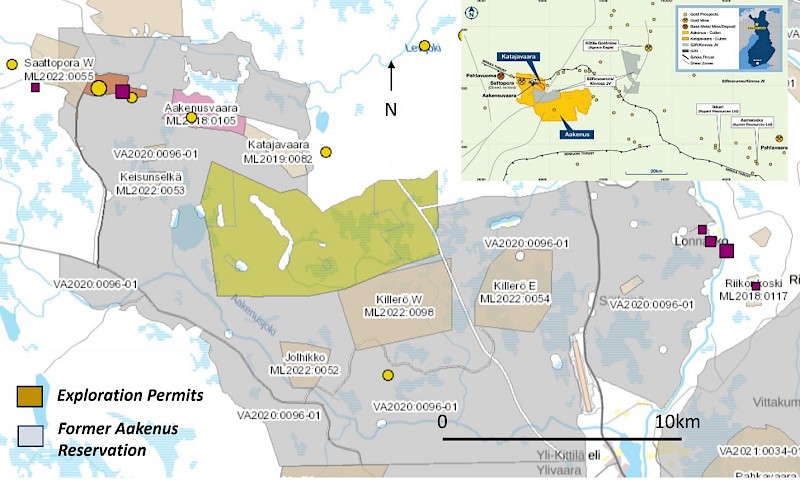

As the original Aakenus reservation expired on December 21, 2022, a total of six EPLA’s were applied for over specific gold and/or copper targets including the significant historical gold-copper Bottom of Till (“BoT”) geochemical anomalies generated by Anglo American PLC in the Killero E area, and potential extensions to Outokumpu Oy’s former Saattopora gold-copper mining operation (Figure 1). Five of the EPLA’s were granted on May 26, 2023, with the sixth still in the processing stage.

Figure 1. Locations of the five granted exploration permits – Saattopora W, Kelsunselka, Jolhikko, Katajavaara, and Killero E.. The Killero W EPLA is still at the application stage.

Project Snapshot

|

Location |

20 km NW of Kittila, Finland |

|

Ownership |

Capella Minerals Initial 70% Interest |

|

Status |

Early-stage exploration |

|

Deposit types |

Orogenic gold & copper deposits |

|

Project Area |

5 granted exploration permits; one pending |

|

Host Rocks |

Meta-volcanic/sedimentary sequences |

|

Age |

Precambrian |

|

Main Economic Elements |

Gold, Copper |

|

Access |

All weather paved highways and gravel roads |

Central Lapland Greenstone Belt

Capella’s Northern Finland Gold-Copper Project consists of 5 granted EPLA’s covering an area of approximately 42 square kilometres, and lies immediately adjacent to the Sirkka Thrust Zone, a well-mineralized regional structural corridor within the Central Lapland Greenstone Belt (“CLGB”). Significant recent discoveries within the CLGB include Ikkari (Rupert Resources) with a current Indicated Mineral Resource of 48.3MT @ 2.5 grams per tonne (“g/t) gold (“Au”) for 3.86Moz Au and Inferred Mineral Resource of 20.4MT @ 1.9 g/t Au for 1.26Moz Au; NI 43-101 Technical Report dated January 10, 2023 and filed on www.sedar.com1.

1 References made to nearby mines and analogous deposits provide context for the Northern Finland Gold-Copper project but are not necessarily indicative that these projects host similar tonnages or grades of mineralization.

Priority Targets Defined within the Northern Finland Copper-Gold Project

An initial five exploration permit licence applications (“EPLA”) within Aakenus were submitted in September, 2022 based on interpretations undertaken of Capella’s high-resolution drone magnetic dataset and historical geological and geochemical datasets. The EPLA’s were granted on May 26, 2023 annd cover the following targets:

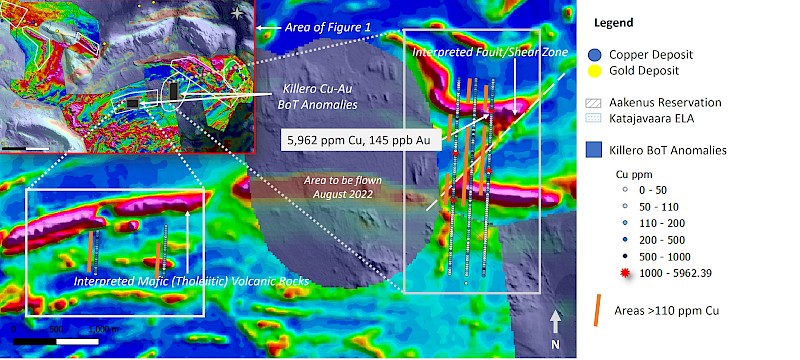

- Killero E – designed to cover the exceptional copper-gold values returned from historical BoT sampling by Anglo American PLC1 but never followed-up with core drilling. The Killero BoT anomalies are also associated with a prominent NE-trending structural corridor (Figure 2).

- Saattopora W – covers an interpreted WNW trending extensions to Outokumpu Oy’s former Saattopora copper-gold mine, in addition to some previously unknown NW-trending splays.

- Keisunselka – high-grade gold target in interpreted deformed banded iron formation

- Jolhikko – gold and base metal targets in complex deformation zone

- Katajavaara – intepreted SE extension of the former Saattopora mining operation.

Figure 2. Enlargement of the Killero copper-gold BoT anomaly area. Background: Total Magnetic Field Intensity (TMI) data.

An additiional EPLA was submitted in December, 2022:

- Killero W – designed to cover further exceptional copper-gold BoT anomalies originally defined by Anglo American PLC1 but not core drilled.

- Sätkenävaara – large unexplored zone with significant structural complexity, potential for orogenic gold deposits.

Approval of the exploration permits allows for the commencement of significant field work programs (such as additional BoT sampling and core drilling) starting H2, 2023.

1 Historic geochemical results quoted for Killero are derived from GTK (Geological Survey of Finland) datasets. Whilst Capella has not performed sufficient work to verify the published data reported, the Company believes this information to be considered reliable and relevant.

Terms of Capella’s Earn-In

Capella’s earn-in agreement for the Northern Finland Gold-Copper Project was announced on August 24, 2021, and received TSX.V Exchange approval on September 7, 2021.

Key terms of the earn-in agreement are:

- Capella acquired an initial 70% interest in Cullen Oy (Cullen’s 100%-owned Finnish subsidiary, and registered owner of the original Katajavaara EPLA and Aakenus reservation) in return for having paid Cullen AUD 50,000 upon receipt of Exchange approval (the “Closing Date”).

- Capella will be required to invest a total of USD 250,000 in exploration expenditures on the two projects over a 24-month period from the Closing Date.

- Capella may then acquire a further 10% interest in Cullen Oy (for a total 80% interest) in return for a further USD 750,000 investment in the two projects over a 4.5-year period from the Closing Date.

- Cullen will then be free carried until the completion of a Pre-Feasibility Study (“PFS”) on either of the two projects. Thereafter, a standard dilution formula will apply and should either party’s direct interest fall to below 10% then they will revert to a 2% Net Smelter Royalty (with 1% being purchasable for USD 1 million).

In addition, the following cash payments are required to be made to Cullen:

- USD 50,000 on the first anniversary (September 7, 2022) of the Closing Date (completed)

- USD 75,000 on the second anniversary (September 7, 2023) of the Closing Date (pending)

- USD 100,000 on the third anniversary (September 7, 2024) of the Closing Date (pending)