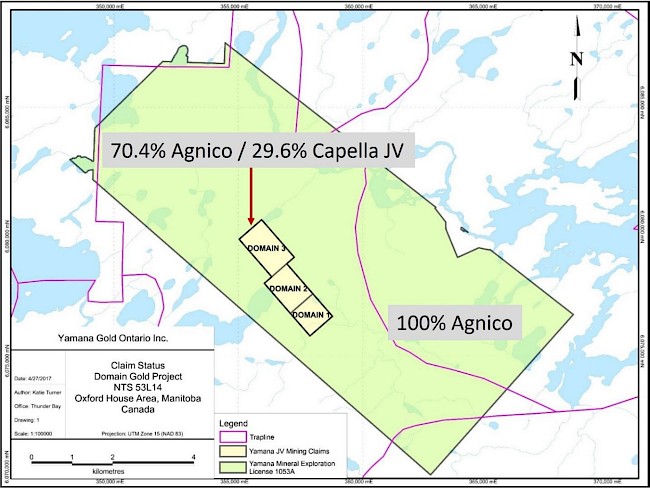

The Company’s Domain Gold Project is located in northern Manitoba and is a Joint Venture (“JV”) between Capella Minerals Ltd (29.6%) and Agnico Eagle Mines Ltd (70.4%)(“Agnico”). Agnico is the Joint Venture operator.

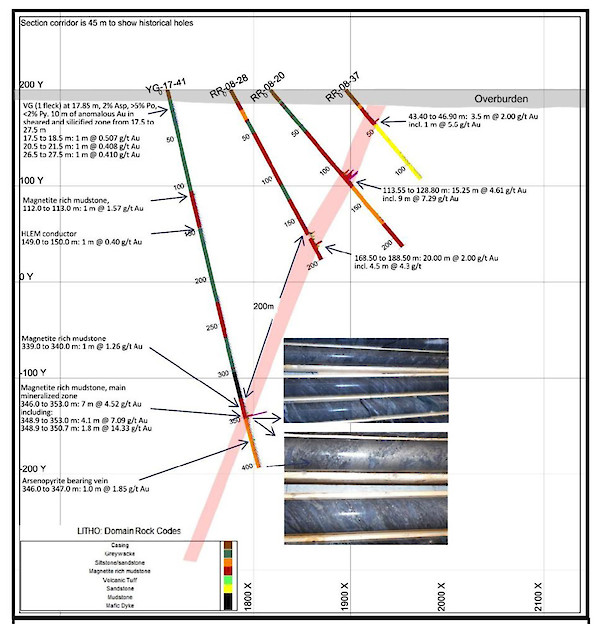

A total of 62 holes / 9,660m of diamond drilling has been completed at Domain, and this drilling has successfully intersected significant, high-grade iron formation-hosted gold mineralization. Drilling to date has been focused on the “Main Zone”, where the high-grade gold mineralization has been partially tested along some 800m of strike and remains open at both depth and along strike. A further 5km of prospective strike length for gold mineralization remain to be drill tested.

Project Snapshot

| Location | 15 km SE of Oxford House, Manitoba |

| Ownership | Joint Venture between Capella Minerals Ltd (29.6%) and Agnico Eagle Mines Ltd (70.4%) Agnico is the Joint Venture Operator |

| Status | Advanced-Stage Exploration |

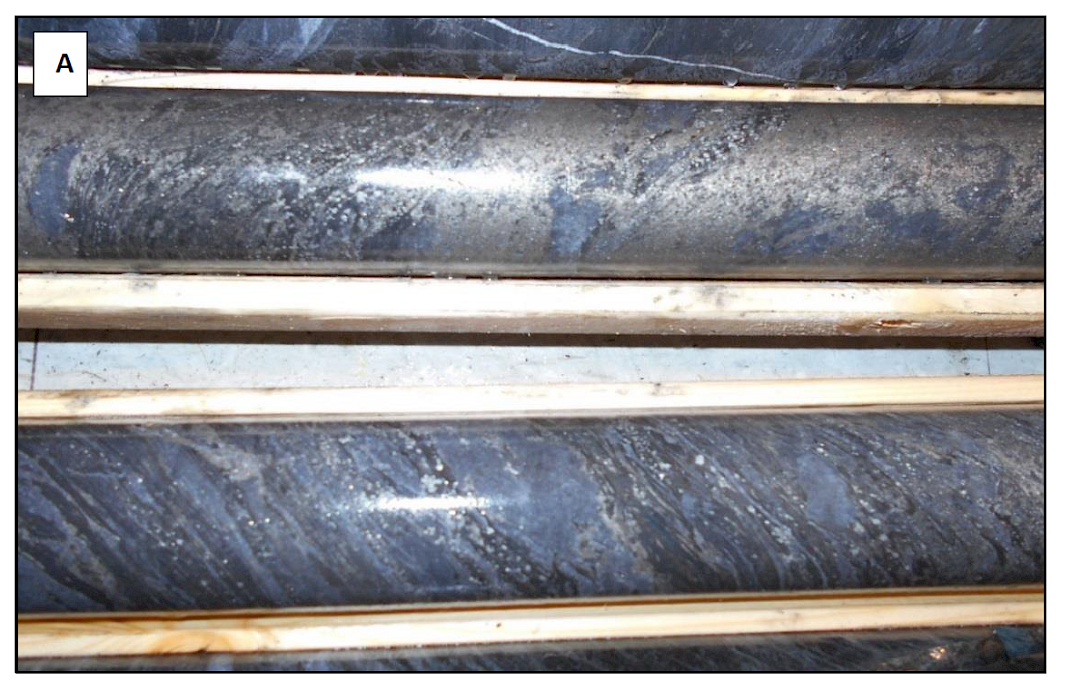

| Deposit types | High-grade iron formation- and shear-hosted gold |

| Property Size | 576 hectares (JV claims) |

| Host Rocks | Oxford Lake-Knee Lake greenstone belt |

| Age | Precambrian |

| Main Economic Elements | Gold |

| Access | Major winter road |

Domain JV Area

Figure 1. The Domain JV area covers the Domain 1-2-3 mineral claims.

Drilling Completed and Upside Potential

The Domain JV claims total 576 hectares (Figure 1) and cover an area in which 62 holes / 9,660m of historic drilling have been completed and which successfully delineated significant high-grade iron formation-hosted gold mineralization. Notable intercepts from this drilling include: RR-08-23, 2.65 metres (“m”) at 17.44 grams per tonne (“g/t”) of gold (“Au”) and 2.67m at 10.43 g/t Au; RR-08-21, 2.70m at 15.16 g/t Au; and RR-08-20, 9.0m at 7.29 g/t Au (see Company News Release dated June 12, 2017). True widths are estimated to be 80-100% of core length based on limited drilling.

Drilling to date has been focused on the “Main Zone”, where high-grade iron formation-hosted gold mineralization has been partially tested along some 800m of strike and remains open at both depth and along strike (Figures 2 & 3). The “Main Zone” mineralization lies on a prominent, northwest-trending HLEM (Horizontal Loop ElectroMagnetic) anomaly, and a combined strike length of approximately 5km of HLEM anomalies remain to be tested within the Domain JV area. Drilling of HLEM conductors during the last drill program in the winter of 2017 was successful in discovering additional gold mineralization.

2023 Work Program

Agnico became Capella’s JV partner at the Domain Project on March 31, 2023, upon the completion of its Corporate merger with Yamana Gold Inc (“Yamana”). Capella and Agnico are currently reviewing strategic alternatives for Domain.

In Q3 2020, Yamana had entered into an Exploration Agreement with Bunibonibee Cree Nation to develop a cooperative and mutually beneficial relationship relating to mineral exploration within the Traditional Territory of Bunibonibee Cree Nation. The current focus at Domain is on Community Relations activities and archeological studies to support an eventual exploration permit application.

Prior to its acquisition by Agnico, Yamana had considered the Domain project to be a “Tier Two” project, defined as being “Projects that have achieved significant drill intercepts and whose geology along with other factors support rapid resource growth”. Yamana also stated (see YRI Company News Release dated December 3, 2020) that the objectives of their generative program are the discovery of stand-alone projects with inferred mineral resources of at least 1.5 million gold equivalent ounces.

Capella holds a participating 29.6% interest in the Domain JV, however, retains the option of diluting its interest should it elect not to participate in any future program proposed by Agnico. In the event that Capella’s direct interest in the project should fall below 10%, it would revert to a 1% Net Smelter Royalty.